Louis W. Dawson 1 (1897-1989) — 1950 Corporate Biography

NOTE: This article refers to Louis Dawson the first (1896 – 1989 R.I.P. ), not his grandson L Dawson the second.

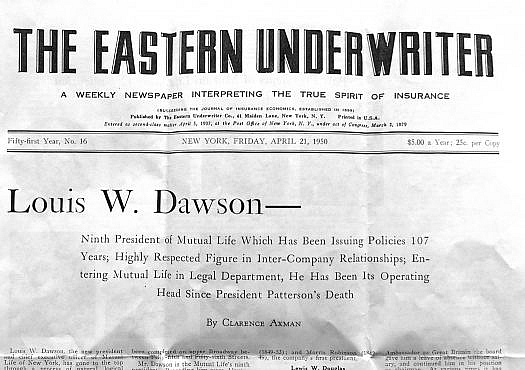

Eastern Underwriter insurance industry newspaper, April 1950

From: THE EASTERN UNDERWRITER — A Weekly Newspaper Interpreting The True Spirit of Insurance — April 21, 1950

Summary: Louis W. Dawson — Ninth President of Mutual Life Which Has Been Issuing Policies 107 Years; Highly Respected Figure in Inter-Company Relationships; Entering Mutual Life in Legal Department, He Has Been Its Operating Head Since President Patterson’s Death.

By Clarence Axman — 1950

Louis W. Dawson [the first], the new president and chief executive Officer of Mutual Life of New York, has gone to the top through a process of natural, logical stages. Along the journey he has been a constant builder of good will. His associates at Mutual Life and his confreres in Association of Life Insurance Counsel and fellow-committeemen of the Life Insurance Association of America and American Life Convention believe one of his paramount traits is that of balance.

A tall, broad-shouldered, outdoor-loving man of large physique, athletic enough to have been captain of a basketball team for two years; friendly in disposition, thoughtful, careful, non spectacular, not easily upset and possessing unusually keen mental qualities, Louis Dawson is one of those individuals who inspire general confidence. This has resulted in his opinion being frequently sought in the large field of general problems of the business. While many of such matters are naturally related to law, taxation and contracts they include most every division of the insurance business as he has been operating head of the Mutual Life since the death in 1948 of Alexander E. Patterson; has been a trustee since 1941, and has been general counsel since 1938. At field conventions of Mutual Life he is a familiar figure, often on the program.

Mutual Began Issuing Policies 107 Years Ago

Mr. Dawson’s new post is that of chief helmsman of the oldest company in the western hemisphere writing life insurance. For more than 107 years it has been issuing policies. At the end of 1949 its assets were $2,075,000,000; and its insurance in force was $4,316,000,000.

For decades its massive stone-constructed building, covering almost a square block fronting on Nassau Street, has been a sight which has greatly impressed visitors to the metropolis as a symbol of financial strength and solidity. This month the company leaves the financial district and moves into its new 25-story head office which has just been completed on upper Broadway between Fifty-ninth and Fifty-sixth Streets.

Mr. Dawson is the Mutual Life’s ninth president. Preceding hime were Alexander E. Patterson (1947-48) who died in office; Lewis W. Douglas (1940-47); David F. Houston (1827-39); Charles A. Peabody (1906-27); Richard A. McCurdy (1885-1905); Frederick S. Winston (1853-1885); Joseph B. Collins (1849-53); and Morris Robinson (1842-49), the company’s first president.

Lewis W. Douglas

The announcement that Mr. Dawson wold be chief executive of Mutual Life was made on March 9 by Lewis W. Douglas at the time of the election of Mr. Dawson to the presidency.

When Mr. Douglas was appointed Ambassador to Great Britain the board gave him a leave of absence without salary, and continued him in his position as chairman. At various times it has been reported in the daily press that Mr. Douglas would retire from his diplomatic post, and, returning to America, would devote his future attention to the Mutual Life’s affairs, but circumstances have not made this feasible. These circumstances are linked with crises in world affairs.

As American Ambassador Mr. Douglas has been a participant in numerous international conferences in which America is playing such an important role with future world peace as its main objective, and these have sometimes necessitated his presence in Paris, Berlin and some other world capitals. He is one of the men holding posts in the government of paramount importance whose splendid service to the nation is everywhere acknowledged and which service is all the more valuable when there is continuity. Such public service entails personal sacrifice. When Mr. Douglas finally retires from the diplomatic field and returns to full-time service with Mutual Life his duties as chairman will be to serve as counselor to the board of trustees and officers of the company.

Family Background and Some Early Experiences

L. W. Dawson, whose ancestry is British, Dutch and French, was born in Boonton, N. J., where the family has lived for decades, two of his brothers and his son still residing there. His father’s family had its American roots two centuries ago. His mother was a member of the Crevier family [of France]. His grandfather, Nicholas Jacobus Dawson, was in the lumber and hardware business in Boonton, the town’s leading business man. His late father succeeded to the business and it is now run by his brothers under the name of Dawson Lumber & Coal Co. Louis W.’s son, Craig, named after former Controller Charles L. Craig of New York City, a relative by marriage, is also with the lumber company.

When a boy of 10, Louis Dawson had his first experience in salesmanship. He built up a Saturday Evening Post route in Boonton. This involved paying three cents a copy for the magazine, selling it for five cents a copy and fixing for himself a goal of 40 copies a week. In an exceptionally good week he sold half a hundred copies. In recalling that experience running around town after school hours with SEP subscriptions to sell he recently said to a business friend:

“Building up that route is one of my pleasant memories. It meant in an unusually good week having contact with at least 50 persons and visiting a large number of homes. Sometimes I would see the father; sometimes the wife, and I learned a good deal about salesmanship from this experience which probably stood me in good stead in later years. One of the principal things I learned is that most persons won’t buy anything but necessities unless solicited, but often when solicited their attitude is: ‘That’s a good idea; why didn’t I think of it before?'”

“Every competent insurance agent learns this early in his sales career. He knows that many persons are constantly harassed by acute needs, grouse about them, accept them with resignation, but devote little thought to the fact that such economic problems can successfully be handled through life insurance ownership, in many instances without real sacrifice-just a wiser readjustment of their expenditures. But the great majority of those persons will not buy life insurance unless approached by a man who can ascertain the facts about those needs and then present the plan which solves the problem.”

In World War 1 Navy [Coast Guard]

After attending grammar school in Boonton Louis Dawson was graduated from high school where for two years he was captain of the basketball team. During vacations he did some work piling and selling lumber. Because of the family’s business he decided he would study forestry and attended the Forestry School at Cornell. He left Cornell for service in World War I. At the end of his first college year he enlisted in the U. S. Naval Reserve and went on active duty as a second class seaman, serving on various craft in coastal waters.

Late in 1917, following President Wilson’s order that college students who were not engaged in essential service return to their studies, he went back to Cornell. This time he entered the law school and after a year of study he returned to active service in the Navy. When the Armistice was signed he had advanced to gunner’s mate second class and was attending the Ensign’s School at Pelham Bay. Once more going back to Cornell he completed his legal education and received his LL.B. degree in 1919.

Editor of Cornell Law Quarterly

Louis Dawson was an outstanding member of the Cornell student body. He was awarded the Boardman Scholarship which is given annually to the man who ranks highest in his class after two years of study and for additional qualities of high character. Also, he belonged to the Order of the Coif, an honorary law society whose membership is based upon scholastic standing. Another honor given him at Cornell was his appointment as editor-in-chief of the Law Quarterly. The faculty picks members of the staff of the Law Quarterly and later selects the chief editor, basing the choice on administrative and editorial abilities. Under Mr. Dawson’s editorship many articles were published from the pen of judges and eminent lawyers as well as some professors.

Mr. Dawson helped pay some of his Cornell expenses by being a member of the college orchestra which played weekend engagements for dances at Elmira College, Wells College and other educational institutions. So successful was this orchestra that it had offers of European engagements. The instrument Louis Dawson played was the banjo-mandolin and he has always taken an interest in popular music.

While he was at Cornell one of the students was Mary Donlon, now chairman of the New York State Workmen’s Compensation Board and who is administering the recently enacted Temporary Disability Benefits law for workers in New York State.

Partner in New York Law Firm

Following his graduation from Cornell Mr. Dawson joined the New York law firm of Powell, Wynne & Roberts, which later became Powell, Lowrie & Ruch, in which firm he became a partner in 1926. Marvin Wynne left the law firm and became assistant general counsel of the Mutual Life under Frederick L, Allen, general counsel. One day while Dawson was walking down the street he encountered Wynne who started discussing the Mutual Life and said to Dawson:

“Would you be interested in coming with the Mutual Life? We can use another good man and there is plenty of work to do.”

Joins Mutual Life

That meeting resulted in an interview with David F. Houston, then president of the Mutual, who offered Mr. Dawson the position which he decided to accept. He joined the company on October 22, 1928. as a law assistant under the late Frederick L. Allen. His early experiences with the Mutual had to do with trial work and advising the financial department respecting purchases of securities, details of indentures and similar duties. In 1936 he became assistant general counsel and in 1938 he was appointed general counsel.

In Mutual Life Mr. Dawson’s executive talents and exploratory instincts, demonstrated by inherent desire to be thorough and to analyze all sides of a question, had long been recognized. Firm is his belief that in head offices of insurance companies “situations” frequently arise which would not be facing executives for solution if planning had been carefully prepared. A predominant trait is his ability to evaluate problems in such a way that he places emphasis on essentials which he feels should most command his personal attention. When he delegates authority it is with full trust in the person given the task to do.

While quick to make up his mind after fact-assimilation he does not believe in too speedy a decision, or in putting the cart before the horse, always bearing in mind relative measurement of importance. Thus, he has been considerably impressed by the philosophy of Gustav Metzman, president of New York Central Railroad, which is found on placards in his office and of some other executives of Mutual Life. The placards are headed by the caption: “Is URGENT Important?” and this is the Metzman philosophy:

“Most business men generally are so busy coping with immediate and piecemeal matters that there is a lamentable tendency to let the ‘long run’ or future take care of itself. We often are so busy ‘putting out fires,’ so to speak, that we find it difficult to do the planning that would prevent those fires from occurring in the first place. As a prominent educator has expressed it, Americans generally ‘spend so much time on things that are urgent that we have none left to spend on those that are important.’”

Given Charge of Company Operations in 1948

Lewis W. Douglas came to the Mutual Life in January, 1940, after being principal (president) and vice chancellor of McGill University and after holding the position of Mutual Life’s president was made chairman of the board in the Spring oi 1947. Alexander E. Patterson came to the Mutual in July, 1941, to be vice president in charge of insurance affairs and in March, 1947, was elected president after Ir. Douglas had been appointed Ambassador to Great Britain. When Hexanier E. Patterson died in September, 1948, Dawson was put in charge of the company and was elected executive vice president in January, 1949.

In 1941 Mr. Dawson became a trustee of the Mutual, the only other Mutual Life officer on the board being Mr. Douglas. As general counsel he had had contacts with all divisions of the company, an experience which gave him a very wide comprehension of the entire insurance institution and proved a tower of strength to the board.

Reorganized Law Department

Following the death of Marvin Wynne Frederick L. Allen, general counsel, had given Mr. Dawson free scope in reorganizing the law department. His three chief assistants in that department have been Haughton Bell, John G. Kelly, and Vincent Keane, assistant general counsel.

In Mr. Dawson’s opinion the ideal law department organization in a large insurance company is comparable to that of a well integrated, high class law office capable of handling any problem presented to it. Law departments, very much as do law offices, tend to become specialized although there are usually cross currents of activity. These specialists tend to follow the organization of the company itself, which in insurance is usually along functional lines.

Foremost are the activities generally referred to as insurance operations. This includes all those activities connected with the sales of life insurance, followed by service to policyholders and ending with the reason a life company is in business — the payment of benefits. The other major activity in which a life insurance company engages is the investment of funds, divided generally into securities investment and real estate mortgage investment. Incidental to the business as a whole are other activities such as proper corporate procedure and maintenance of records, payment of Federal, state and municipal taxes, compliance with insurance laws of the various states and the functions incidental to any large corporate organization. This description of company activities points the way to the specializations of the average law department.

The functions of a life insurance law department most immediately concerned with the field are those dealing directly with insurance operations themselves. For example, there can be no more important function than the preparation of a policy form. Such a job, if properly handled, is confined to no one department of a company, but should be engaged in by the actuary’s agencies, selection, public relations, law department and, in fact, every department of the company whose experience and knowledge can assist in bringing about the best possible policy or other company form.

Inter-company Activities

For years Mr. Dawson has been active in inter-company affairs, his latest honor being his election last week as president of the Association of Life Insurance Counsel. He was chairman of the Joint Legislative Committee of the American Life Convention and Life Insurance Association of America. His two most immediate predecessors as chairmen of that committee were James A McLain, president of Guardian Life, and Charles G. Taylor, Jr., executive vice president of Metropolitan Life. Mr. Dawson is on the life insurance law committee of American Bar Association, and, for the life insurance business, is a member of the Committee on Federal Income Tax of Life Insurance.

Another committee on which Mr. Dawson served was that representing the industry to meet with the committee of Insurance Commissioners in joint consideration of matters which resulted in the so-called Guertin legislation out of which grew the Commissioners’ Standard Mortality Table which took the place of the old American Table of Mortality. For five years he was chairman of the companies’ committee on Affirmative Legislation for New York State. He is treasurer and a director of Life Insurance Guaranty Corporation, membership in which consists of companies domiciled in New York State.

In 1941 Mr. Dawson was appointed a member of the Panel of Arbitrators of American Arbitration Association.

Fishing His Favorite Recreation

Mr. Dawson’s chief recreation is fishing and he has gone on many outdoor trips with a Cornell University classmate, Irvin B. Tiedeman, who is special reviewer of policy payments in head office of Mutual Life.

The first trip they took was in 1921 when they decided to explore the upper reaches of the Connecticut River. Those reaches are pretty far up, as the river is formed of springs coming down from Canada. Louis Dawson had been fascinated by reading the exploits of John Ledyard who, in the middle of the Eighteenth Century when a student at Dartmouth, had hollowed a canoe out of a tree and made the first exploratory trip down the Connecticut River.

Dawson and Tiedeman acquired a canoe and camp equipment, and trained for the trip to Sheepshead Bay. Later, arriving at the Connecticut River they negotiated three miles through the fast current by hard paddling and then ran into difficulties. By reason of a strike of employees of the International Paper Co. they encountered a continuous series of log jams which necessitated long overland portages of canoe and equipment, to the frequent accompaniment of thunderstorms. By the time they reached White River Junction they came to the conclusion that it was not the opportune time for exploring the river’s upper reaches.

One fishing experience which Mr. Dawson annually enjoys is at Peconic Bay when the schools of weakfish come in. Over the years, Mr. Dawson has caught sailfish, tarpon and other game fish off Florida waters, and he and Mrs. Dawson have also made several fishing trips for bass, muskellunge and lake trout in Lake Ontario.

Mr. Dawson’s recreational reading tastes cover a wide range and like many men who have won distinction in law he likes mystery stories and historical novels. However, his favorite book is the autobiography of Benvenuto Cellini.

Mr. Dawson is married to the former Elizabeth Byrne and they live at 25 Central Park West, New York City. At one time they lived in Ridgewood, N. J., where Mrs. Dawson was active in civic affairs and was on board of directors of the Women’s Republican Club.

(end)